How Much Does it Cost to Build Digital Banking App Like RAKBANK?

How Much Does it Cost to Build Digital Banking App Like RAKBANK?

The never-ending paperwork, waiting for a token number, and working hours make banking operations difficult for clients.

People these days are too busy with their daily routines and have no time to invest in the slow banking process. They are showing interest in using technology that can complete these operations with limited efforts.

Mobile and internet banking have made the life of bank clients easy and simple. These technologies help many banks to provide better digital banking services to their customers.

The entrepreneurs are interested in developing these mobile banking applications that bring more revenue into the business. Among all the banking apps, the RAKBANK app has features that are beneficial for banks and clients. Let us see more details about the development of mobile banking apps like RAKBANK.

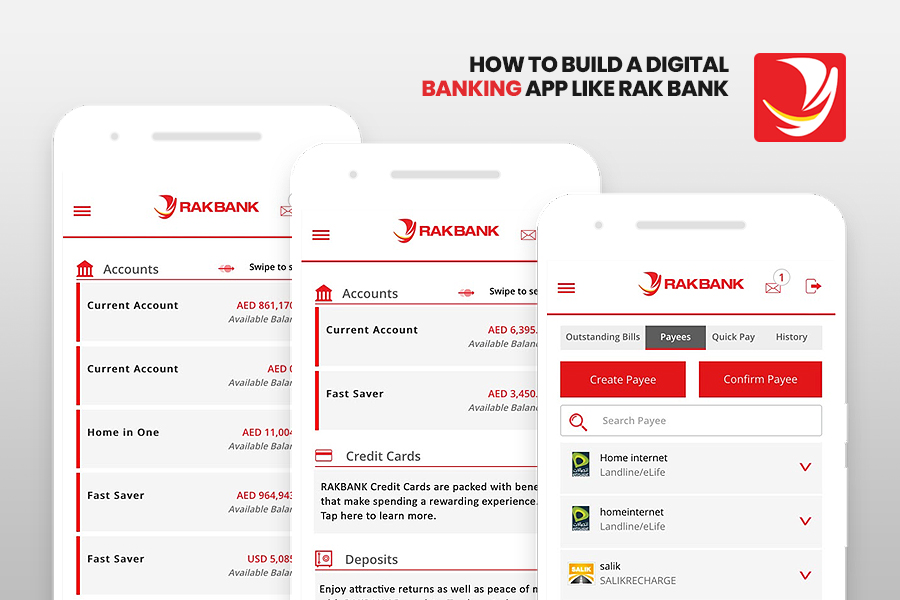

About RAKBANK Mobile Application

RAKBANK stands for National Bank of Ras Al Khaimah (P.S.C), which is one of the prominent banks in the UAE, Middle East region. It is founded in 1976 and serves in all regions of the United Arab Emirates. The bank has transformed to personal and business banking from corporate banking in 2001.

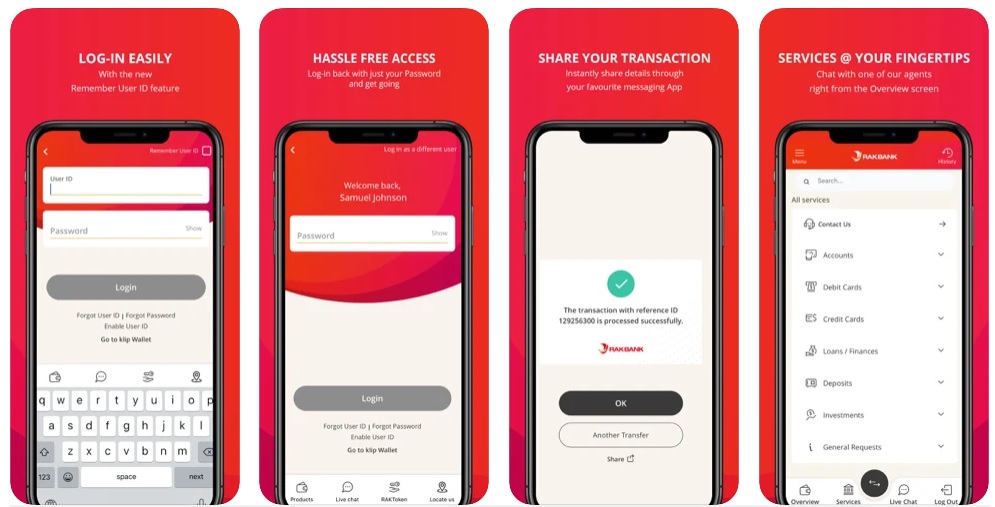

The RAKBANK mobile application offers a convenient and secure way for clients to conduct their bank operations. The user-centric features of the app make it the best digital banking mobile application in UAE.

Why Do We Need Digital Banking Apps like RAKBANK?

- These days over 36% of smartphone users access their bank accounts using mobile banking applications. They are doing transactions online using apps. This has increased the banking apps usage rate by 33% in 2021 from last year.

- The demand for banking apps also increased from business leaders. They prefer using smartphone apps frequently for sending or receiving bills or payments. Since app like RAKBANK offers next-level banking solutions and services to the both personal and businesses, it’s a right choice to develop banking apps like RAKBANK.

- The present generation technologies compatible with smartphones are making everything effortless for the users. So, it is the right time to enter the banking industry with RAKBANK clone apps and offer hassle-free digital banking solutions.

- User’s switch from desktop to mobile also witnessed a sudden growth of banking apps development. This may give wide business opportunities for banking services providers to come up with an app like RAKBANK.

What are Digital Banking Solutions?

There are three types of digital banking solutions as follows.

- Internet Banking App

As the name says, these banking applications open in the internet browser of your desktop or smartphone. Clients can manage all their bank account details from the web.

- Mobile Banking Apps

Mobile banking apps are the frequently used digital banking solutions. The users can access bank account details, check history, account balance, and perform actions like payments, deposits, create FD on their smartphones at any time.

- Client Based Apps

Client-based apps are useful for corporate customers and work only on desktops. The clients first install these apps, and then banks provide access to the database and banking systems to make payments.

Significant Features of Mobile Banking Apps like RAKBANK

Mobile banking applications are the cost-effective way to complete all banking operations at low service fees. It is the main reason behind the popularity of these apps among users.

The banks provide extended due periods to mobile banking users, which is quite helpful for clients.

The users of mobile banking apps benefited from the higher deposit rate, which attracts more clients to these apps.

We can see these mobile banking apps partner with famous third-party online services and offer more discounts on online shopping.

Tips to Develop an App like RAKBANK?

If you plan to develop a RAKBANK clone app, get in touch with the best Banking Mobile App Development Company that has expert app developers. A top mobile apps developer who knows all the latest technology can only develop flawless mobile banking applications.

Before consulting any mobile app development company, you must have a rough plan about the features, design, and development cost of the banking mobile application. Here are few tips for building a mobile application.

Things We Need to Consider Before Developing Mobile Banking Application

- Clear UI/UX Design

Developers need to create a banking application with an effective user interface design. It should be easy-to-understandable and easy to use.

Get in touch with experienced banking mobile app developers like USM for banking app development. USM, the top mobile app development company in the USA, UAE, and India, develops feature-rich and best-in-class mobile applications within your budget limit.

- High-level Security

It is one of the essential features that every client expects from a mobile banking application. Users trust mobile banking applications when we prioritize the security of their accounts.

Developers can add data encryption technologies for ensuring secured data transactions. Your app should provide security to electronic signatures, passwords, authentication codes, and more. They should also follow all necessary government guidelines to improve security while developing the application.

- Banking APIs

The banking APIs will help mobile banking apps to connect with third-party companies. It helps banks to provide more services for the customers. So, the developers should know about the latest technologies used in mobile banking and features that can offer advanced banking management.

- Personalization

App with simple UI, quick page navigation, appealing color, and customizable themes can increase app personalization. Further, push notifications on loan offers, and transaction reminders will offer more personalized services to customers.

Development Cost of Building App Like RAKBANK

On average, the development of a mobile banking application with basic features costs around $50,000 and whereas a complex design and full-featured banking mobile app cost around $150,000. The development time required for this digital banking application is approximately ten weeks, with 120 working hours per week.

The development cost of banking mobile applications for Android devices is more compared with iOS and windows. It is because of the many compatible test runs with various Android versions. The location of the mobile app development company also impacts the development cost.

As the development of digital banking applications requires more effort and investment, you need to partner with a leading mobile app development company. USM has proven experience in delivering feature-rich mobile banking applications in precise time and budget.

Conclusion

Mobile banking apps are convenient and time-saving to complete bank tasks like transactions, deposits, and access account details without visiting the physical location.

If you have an idea of developing a mobile banking application, then make sure to look over the features and development cost. Get in touch with, USM the best mobile app development company to implement advanced functionalities to your mobile banking application.