AI in Insurance: Emerging Role of AI in insurance sector

What Is The Role Of AI In Insurance?

Artificial Intelligence (AI) has become an empowering asset for many industries. This trending technology, with Machine Learning, Deep Learning, Natural Language Processing, Speech Recognition, and Predictive Analytics techniques, ensure incredible business transformation and automation benefits to the industries.

Companies across various industries are adopting AI, implementing AI applications, and witnessing rapid progress in terms of operational and financial ways. The insurance industry is not away from AI. The use of AI in the insurance industry is growing for accelerating automation across the claiming processes and augmenting service levels.

For automating claims underwriting processes, predicting risks, checking credit eligibilities, finance & accounts management, offering personalized policies, product/service branding, and sales monitoring & strategy planning purposes, the use of AI in the insurance industry is increasing. It has opened up new opportunities for this revolutionizing AI in the insurance sector.

So, the impact of AI in insurance sector on all facets, starting from underwriting to product promotion and detecting high-risk customers and fraudulent acts. In this article, we would like to give you a detailed guide on the top use cases of AI in insurance and the top benefits of AI in the insurance industry.

The Growth Of AI In Insurance Sector

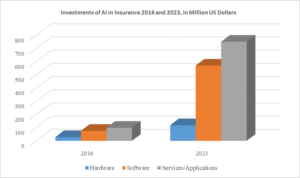

Driven by intelligent automation capabilities investments in AI technology are rapidly increasing worldwide. According to the leading market research companies, with a Compound Annual Growth Rate (CAGR) of approximately 12%, the market value of AI in insurance has witnessed a solid growth between 2019 and 2022.

With a focus on implementing robust digital insurance models and staying ahead of intensified competition, insurance companies are expected to adopt AI-like automation technologies and optimize their business outcomes. The figure below depicts the growth of AI in insurance sector.

Top Applications Of AI In Insurance

How Is Artificial Intelligence Impacting The Insurance Industry?

Insurance companies are planning to augment their digital capacities and increase their operational efficiencies like before. Unlike boring traditional insurance methods, the companies are implementing new avenues to ensure streamlined workflows, improved customer experiences, optimized brand value, and stable business growth.

Let’s take a look at the AI in Insurance use cases:

- Writing Claims and Processing

It is one of the top AI applications in insurance. Many insurance service providers are harnessing the power of AI and automating routine claims underwriting and processing functionalities. Hence, automating time-consuming processes will save a lot of resources’ time and improve productivity.

Moreover, AI-powered insurance apps automatically validate the details and help service providers’ process multiple claims at once. Hence, by using AI, along with faster processing, service providers can benefit in terms of accurate data verification and reduced time.

2. Risk Analysis and Fraud Detection

At present, some of the AI enterprises and startups are helping insurance companies are using AI-based predictive apps to estimate credit-associated risks. Yes, credit risk is one of the biggest concerns for the insurance sector. The use of AI for fraud detection will assist insurance agents in accurately verifying the users’ credit eligibility.

Software applications developed using AI, machine learning, and predictive analytics capabilities can efficiently monitor patterns of user behavior and transactions, and predict the possibilities into risks.

Hence, insurance companies can identify fraudulent acts and make decisions in claim processing. It will save a lot of money and ensure revenue-driven business processes.

3. Improved Customer Experiences

It is one of the top use cases of AI in insurance. Automated document uploading, eligibility checking, and claim processing all enables streamlined process and optimizes productivity. Besides these benefits, AI-powered conversational chatbots help insurance companies to make their brand available to clients 24*7.

Further, AI-powered applications can also be used for monitoring customer behavior, tracking their search preferences, recommending personalized service offerings, etc. Hence, AI in insurance is used to improve customer experiences.

4. Sales Tracking and Monitoring

It is one Sales of the most advanced applications of AI in insurance. Just like retail, e-commerce, and manufacturing like product-based industries, AI in insurance can also be widely applied for monitoring market trends, measuring sales, and predicting sales opportunities.

AI-powered intelligent sales monitoring apps for insurance companies play a vital role in automatic sales tracking, strategy planning, decision making, prospects management, accounts management, and many more can be seamlessly handled by AI applications.

5. AI In Insurance For Generating Insights

AI applications can process complex data sets (might be sales data, customer data, or input related to the market dynamics) in seconds and generate valuable insights. These insights would help insurance companies make instant decisions for creating the best policies and boost the count of new customers seamlessly. Further, it also helps in offering personalized coverage plans to customers.

Accordingly, the use of AI in insurance industry will also play a significant role in making business development decisions faster. By analyzing market trends and deriving insights from the market trends, AI predictive applications will help insurance companies make informed decisions toward business growth.

Hence, the impact of AI in the insurance sector would be outstanding for making the best business strategies, making more claims, and remaining competitive in the industry.

6. Prevents Cyber Risks

How Will AI Prevent Cyber Security Risks In The Insurance Sector?

Digital mode of communication is vital in this digital space because everyone is spending much time online. By integrating AI in insurance apps, insurance companies can automate core business activities such as claims underwriting, document verification, credit disbursal, and many more.

Likewise, preventing cyber risks is also one of the top uses of AI in insurance sector. The next-generation AI applications can seamlessly monitor the end-to-end network, detect suspicious activities, and block access immediately. Such predictive capabilities of AI technology will assist insurance companies in protecting their information systems from hackers.

These are the top use cases of AI in insurance. Like these AI will impact the insurance industry in the maximum possible ways.

How Will AI Adoption In Insurance Ensuring Benefits?

According to the stats, approximately 43% of AI solutions are working exclusively for underwriting in the insurance sector.

As discussed, AI mobile apps for Insurance can efficiently reduce credit risks, streamline processes, and improve the operational efficiency of insurance companies. Auto and remote management of end-to-end insurance activities will make the processes faster & accurate and save a lot of time.

Such automated processes will be good for insurance carriers to accelerate remote work processes and ensure high productivity. Finally, AI use cases in insurance make underwriting works flexible and help companies provide valuable services.

Moreover, understanding AI in Insurance significance for customer service automation, insurance companies are switching to AI insurance apps. AI has replaced time-consuming meetings with agents in real-time and instead solves every issue instantly over online through chatbot applications. Hence, conversational AI chatbots reduce waiting times, improve service quality, and add value to the insurance business.

Further, adopting AI and ML in insurance apps also helps insurance companies to monitor the policy prices of competitors and set customer-friendly premium policies. It will help insurance companies to attract more applicants and boost their business results.

Final Words

We can confidently conclude that the implementation of AI in insurance industry will boost productivity, modernize processes, enhance claims management, fasten decision-making processes, enrich customer experiences, etc. So, understand the role and use of AI in insurance and the impact of AI in insurance, and let’s invest to grab the benefits of its automation features.

Are you looking to hire an AI app development company to automate your insurance business?

USM is a top AI development company in the USA, with offices in India and UAE. We design and develop next-generation AI Services and solutions that automate entire workflows of insurance service providers.

Let Us Know Your AI Insurance App Idea and Get A Free Quote.

Thanks for this amzing blog, I sincerer agreed with everything you said, I will be viisting again .Once again thanks for an amazin blog

So I took my time to read the entire post and i totally agree with every statement you made. I have to say I love this blog and will always visit again.

It’s actually a cool and helpful piece of information. I

am glad that you just shared this helpful info with us.

Please stay us informed like this. Thank you for sharing.

Normally I do not read post on blogs, however I wish to

say that this write-up very forced me to check out

and do it! Your writing style has been amazed me.

Thanks, very nice article.

You have made some really good points there.

I looked on the internet to learn more about the issue and found most people will go along with your views on this web site.

My spouse and I absolutely love your blog and find most of your post’s to be exactly what

I’m looking for.

Thanks Gina 🙂