Artificial Intelligence in

Banking Industry

User-friendly Banking and Financial Apps that Enhance Your

Customer Experience

USM Develop Results-driven Banking and Financial Apps

We provide AI services to the global Banking and Finance firms. With our expertise in using next-generation AI technologies, we help our clients automate their regular business tasks with lucrative artificial intelligent solutions. ( Recommended to read : 9+ AI Use Cases / Applications & Examples OF AI In Banking )

USM Business Systems help enterprises accelerate digital transformation and empower their ability to run business smartly in this world of a connected ecosystem. We assist your business to commence a transformational journey by using the power of futuristic and advanced technologies. We deliver unbeatable technology solutions and services to clients across United States – Chantilly, Virginia, Frisco, Texas, California and New York.

USM’s Innovative AI Solutions For Banking & Finance Sector

What features our banking & financial mobile apps do include?

Expand Your Brand With AI-driven Banking Apps!

A Single Insurance App For Both Agents And Customers

USM helps insurance companies to offer a multipurpose insurance mobile apps to its clients. Our multi-platform mobility solution helps our insurance clients to provide a great experience to their customers, agents, partners, and employees as well.

- CRM and lead Management

- Premium account generation, reminder, and payment

- Report incidents, seek help, and file claim

Make Your Customers Happy With Our Investment Mobile App

USM’s investment mobile app lets your customers gather portfolio values, a summary of their holdings, and intelligent insights on their investments. Thus, our app makes your customers do smart investments and increase your brand name.

- Smart Investment Advice

- Portfolio Management & Holding Summary

- Regulatory compliance

- Performance Reporting

An Easiest Way To Handle All Your Financial Information

Manual managing daily financial transactions is a tough challenge. USM makes this easier. We develop customized accounting mobility solutions to handle a range of financial information like cash assets, liabilities, and fixed assets.

- Automated invoicing

- Tax preparation and saving

- Bank reconciliation

- Manage multiple businesses

Secure Banking App That Goes Beyond Managing A Bank Account

USM delivers the best retail and corporate banking mobility solutions to global banks. Driven by the development of innovative banking mobile apps, we expanded our brand globally within a short span. We’ve successfully taken the prospects of customer engagement and platform adoption to the next level.

- Personalized and differentiated mobile banking experiences

- Secure, user-friendly and lean methodologies

- Performance-oriented micro services architecture

- Compliance safety App

Pay With A Digital Wallet App Installed On Your Smartphone

USM’s Digital wallet apps empower users to pay 3rd parties, individuals, and banks from their smartphones only. The users can pay through a secured payment gateway using credit cards, debit cards, and internet banking.

- Payment using NFC, QR, and mobile numbers

- In-build passcode and Pin security

- Integration with device secure credentials

- Integration with leading payment gateways

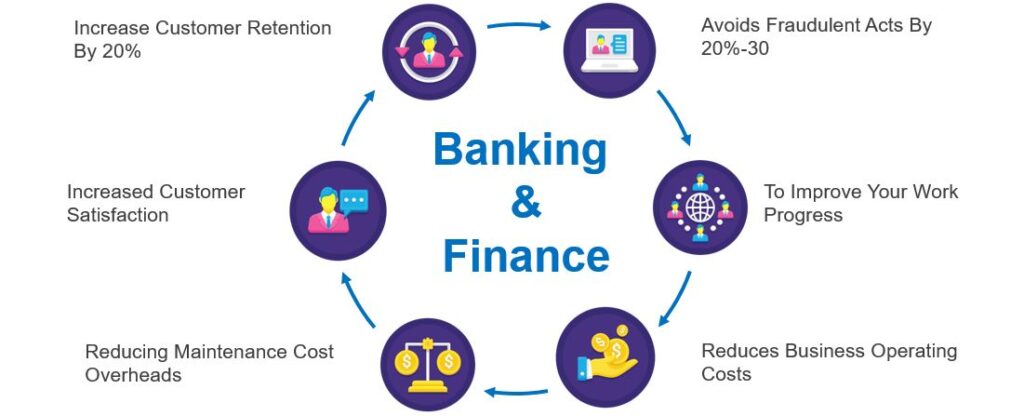

How Our Banking and Financial Mobility Solutions Help Your Business?

0 +

0 +

0 +

Let’s talk About your project

Understanding your requirements and objectives is important to us. We listen and work together to create a truly unique experience.

Lets Start Work together!

Our Clientele

USM has earned reputation and respect from its client by delivering top-notch customized IT solutions. We have satisfied clients from all over the globe.

Why choose USM for your Services?

As a reputed AI mobile app development company, USM has flexible engagement plans for software development projects which are customized according to client specifications.

- 24X7 Support

- Certified Resources

- Predict Trends

- Customer Service

- Actionable Insights

- Diverse Industry

Segments We Have Experience In

USM helps accelerate innovation and gratify industry specific best practices to help run your core business efficiently.

Agentic AI for BFSI

Detect fraud before it happens, not after and that’s the Agentic AI edge in BFSI.

Yes, why chase fraud after the damage is done? Let USM’s Agentic AI detect and block it in real time. USM Business Systems brings next-generation Agentic AI solutions to the BFSI sector. We build self-learning, autonomous multi-agent systems that can successfully audit user activity, transactions, network traffic, and credentials in real-time, identify patterns of fraud, block suspicious transactions, and learn from newly discovered threats on a daily basis.

From retail banking and digital lending to crypto exchange, we build diverse finance fraud detection agents that make financial institutions secure, proactive, and customer-trust ready. Allow USM’s proven experience in BFSI Agentic AI solutions to future-proof your fraud defense tactics.