Robotic Process Automation (RPA) Use Cases & Examples In Banking

RPA In Banking Sector

To stay competitive in a gradually increasingly saturated market, particularly with the widespread acceptance of virtual/digital banking, the banking and financial industry needs to find a way to provide their customers with the best possible customer experience.

Accordingly, increasing business efficiency and reducing operational costs while maintaining maximum security levels as major challenges, banks and finance companies are inviting digital solutions. AI and Robotic Process Automation (RPA) enabled banking apps have become an effective and powerful solution to automate time-consuming tasks and streamline entire procedures.

A 30-Sec Summary on RPA

- Robotics Process Automation is the next phase of technology, which solves many problems in the banking sector. It is emerging as the most efficient way for banks to support their digital transformation efforts.

- RPA will automate the tasks which are manual and more labor, and minimize the actual need for data reconciliation and repeated manual work so that humans can concentrate only on decision-making, complex operations of banking, and human interaction.

- RPA is a low-cost, high-productivity model, and it is currently disrupting all business-process-outsourcing models in all financial institutions, battling intense competition, disconnect from workflow, and misreporting.

- The secret of Robotic Process Automation’s success in the banking sector is its process validation only on a large scale.

What Is Robotic Process Automation (RPA)?

RPA is an AI technology that will automate time-consuming and repetitive tasks faster than humans. RPA solutions minimize the actual need for data reconciliation and repeated manual work so which plays a key role in optimizing productivity and business efficiency.

RPA in banking sector is a very low-cost and high-productivity approach. Implementation of RPA and AI in banking and finance will reshape the old processes and ensure the best results from day one.

Workflow automation, instant customer support, automating loan and credit application processing, automating account opening or closure operations, and managing auditing/investment/trade operations are a few top benefits of implementing RPA in Banking and Finance sector.

Examples Of RPA automation in banking

Let’s have an eye at the below examples of back-office processes in the Banking Industry which will be automated through RPA.

- We can simply detect the fraud through the bank account tracking

- adding new accounts details into the systems, transferring data, and making multiple entries

- RPA for Account reconciliation means copying and moving information

- Report generation from one system to another system

- Extraction E-forms by taking data forms and making system entries

- Cumulative support by making and updating entries

- Mortgage approval, i.e. calculating and moving data from one place to another

- Credit card applications processed from web-forms

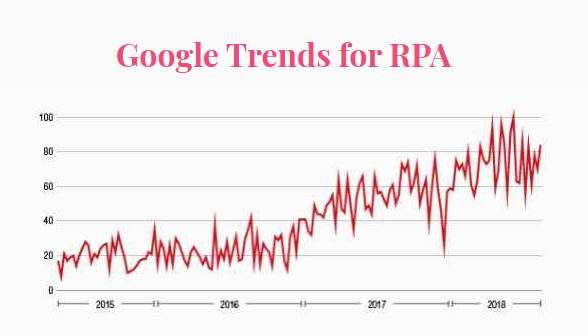

Google Trends Of RPA

Recent RPA trends and forecasts expect that the market for robotic technology in knowledge-work processes would reach US $29 billion by the year 2021. That is a drastic development from the US $250 million in the year 2016 when it has made its mark at first as a mainstream process-improvement tool.

Recommend to read: 10 Use Cases & Examples of Robotic Process Automation in Banking

Let’s take a look at the best RPA use cases in banking sector.

Top 10 RPA Use Cases In The Banking

Recommended to read : 10 Use Cases & Examples of Robotic Process Automation in Banking

Talk to our consultation now : Contact us.

Here are the top RPA use cases in banking and finance industry.

- RPA bots improves customer online experiences

- RPA for Financial Industry or RPA banking applications streamlines the new customer onboarding processes

- RPA in banking sector makes trade finance operations more secure and easily accessible over online platforms

- The role of RPA and AI in banking for processing loan applications automatically and checking the insurer’s eligibility is tremendous.

- RPA banking apps and finance apps can re-route user traffic and instantly deliver accurate responses to every customer

- The use of RPA for financial industry will automate the money laundering operations

- Digital account opening and account opening are also a few top benefits of RPA in banking and finance industry.

- Automatic credit card application processing is another key role of RPA and AI in banking. By analyzing the customer’s account and credit history, intelligent Ai-powered RPA banking apps check whether the customer is eligible for credit card services or not.

- RPA in banking streamlines entire front-office tasks and also plays a key role in automating auditing operations

- Auto-report generation is one of the top RPA use cases in finance industry. Such regular auto-generation of reports will help banks in determining the performance of operations.

These are a few benefits of implementing RPA in Banking and Finance sector. Intelligent and advanced RPA solutions will minimize human interactions, streamlines processes, and improves overall business efficiency.

The impact of RPA in the banking sector would touch the sky in the future. As we discussed in the above list of top 10 RPA use cases in the banking sector, banks & financial institutions can make things faster and easier.

Get the cost of RPA banking app development!

Top USA Banks That Use AI and RPA In Their Banking Sector

Here, we focused on the top 7 banks in the USA that are using AI applications to automate their banking processes.

We covered:

- What kind of AI applications are used by the top USA banks like JPMorgan, Wells Fargo, etc.?

- How AI trends have attracted them to invest heavily in AI and RPA app development?

- How much capital is invested in AI by the United States’ leading banks?

1 . JPMorgan Chase

JPMorgan was the biggest US bank in terms of its annual turnover. In terms of technology investments, also the company stood in first place. According to its annual reports, it invested over $11.4 billion in AI technology. Such a huge investment in AI by the topmost leading US bank shows its interest in technological inventions.

JPMorgan is majorly focused on how to improve its business performance and achieve operational Excellency using AI and RPA-like trending banking technologies.

How Is JPMorgan Using AI Technology?

For conducting quick and automated internal document search, JPMorgan invested in AI banking app development and introduced Contract Intelligence (COiN). This Machine Learning (ML)-enabled interactive Chatbot can retrieve required data from the vast database of legal documents in seconds and generate insightful reports.

JPMorgan also launched an innovative AI initiative, “Emerging Opportunities Engine”, especially for supporting the equity capital and debt capital markets

Want to develop AI-powered Chatbot software? Let’s talk once!

2. Wells Fargo

Wells Fargo is always eager to invest in the most popular technologies like AI, ML, and RPA. They are foot printed into AI with a Chatbot pilot project. Wells Fargo Chatbot application has built on AI technology and helps banking customers in clarifying all their banking-related queries in seconds.

Accordingly, Wells Fargo also introduced an AI-powered mobile app that is developed using predictive analytics. This intelligent Smartphone application alerts customers if their billing payments exceed the limit. Further, this AI tool for banking also guides you with a travel plan after purchasing a plane ticket.

Would you like to offer this kind of Smart AI and RPA banking app?

USM is here to help you out! Get Connected

3. Bank of America

Bank of America is using AI-driven technologies with a major focus on fraud detection and secure online trading functions.

Bank of America’s AI-enabled Chatbot named Erica can understand texts and speech delivered by humans. In addition, the company’s other ML-based Chatbot can advise users and send financial recommendations based on their financial spending. Accordingly, this intelligent AI Chatbot can also block or unlock the debit or credit card of users on their request.

Every bank is rushing towards AI. Why Don’t You?

4. CitiBank

Citibank is using AI and RPA-like next-generation technologies and reaping the benefits of RPA in banking sector to the fullest. To avoid fraud actions and Anti-money laundering, it is investing in AI technology. Recently, Citibank has announced its partnership with Feedzai, helping in the detection of fraudulence.

Feedzai software will monitor the customer’s payment conduct and their location. If it notices a large number of transfers from different locations that the customer is not known to be too frequent, Feedzai software will send an immediate alerts to the respective officials before the transaction takes place.

5. US Bank

US Bank is using AI to provide a personalized experience to their customers. The bank’s Expense wizard is an AI-based mobile app that makes business travel easy. It eliminates the need to use personal cards and wait for reimbursement.

6. Bank of NY Mellon Corporation

BNY Mellon believes the use of RPA in the banking sector saves money, time, and reduces the manual process too. The bank has deployed nearly 20 AI-enabled Chatbot in production which estimated that the fund’s transfer bots alone are saving $300,000 annually.

7. PNC Financial Services

PNC has invested around US $1.2 billion into modernizing its core infrastructure with an aim to build fully-advanced operational and technical capabilities.

Future Of RPA In Banking

Overall, the benefits of using RPA in banking in decision-making and functional improvements are huge. Front-desk banking operations account managing, fraud analysis, predictive analysis, and many more can be done simply in seconds using AI and RPA.

With the help of RPA applications banks and financial institutions can keep their brand on mountain heights so no hacker can steal the information and operations will be done at rocker speed. These are the core reason that will keep the crown to the future of RPA in banking industry.

Let’s discuss your project requirement and get a free app quote!

Conclusion

Hence, the benefits of implementing RPA in Banking and Finance operations are infinite. The impact of RPA in the banking sector in the present and in the years ahead would be unimaginable. Banks modernize their entire functional areas and deliver top-notch customer services 24/7. As modern technologies reduce cost overheads, banks can generate great ROI in a very less span.

To implement RPA technology successfully in the banking sector, it is crucial to partner with an organization that has proven expertise in RPA technology and tools throughout the RPA implementation process.

USM is the best RPA app development partner for you. If you want to impress your customers with your digital banking services, Contact us. We are ready to assist you!