6 Challenges That Fintech Startups Will Face & Efficient Solutions To Overcome

6 Challenges That Fintech Startups Will Face & Efficient Solutions To Overcome

Though the demand for FinTech apps development increases, challenges to stay competitive in the industry will also upsurge. FinTech solutions assist companies in managing their finance, including a budget, investments, trades, and much more seamlessly. Herein, we would like to walk you through what is FinTech, what are the key challenges faced by the FinTech startups today, and the best Fintech solutions to boost business performance in this digital era.

What Is FinTech?

FinTech or Financial Technology is a technology that aims to bring innovation in traditional banking, investment, and financial services. As banks and financial service providers are switching to digital to provide more convenient, secure, and transparent services to customers, the demand for FinTech is on the rise. From banking and budget management apps to Blockchain and trading platforms are all considered as FinTech applications.

Are you looking for FinTech App Development Services? Get in Touch!

What Are The Major Types of FinTech Mobile Apps?

The application type might differ from one to another, but the ultimate goal is to bring automation and enhance customer experience digitally. Here are a few significant types of FinTech mobile applications for android and iPhone.

- Digital banking apps or mobile banking apps

- Investment and Trading apps

- Loan apps

- Insurance Apps

- Equity financing apps

- Auditing and Tax Management Apps

- Cryptocurrency or e-Wallet Apps

- E-Bill Payment Apps

These are the most-used and trending Fintech app types in 2021. So, invest in a category that meets your business needs. Further, you should also select the right type of FinTech App based on the financial services that you provide. Let’s dive deep into FinTech app types.

-

Digital Payment Apps

Digital payment or e-wallet apps are popular in the FinTech industry. From online shopping and entertainment apps to e-learning and marketplace mobile applications, businesses are integrating e-wallet apps like PhonePe and PayPal to ensure fast checkouts and more comfortable and convenient services to their audience. Here is the list of the best digital payment apps.

- Apple Pay

- PayPal

- Venmo

- Google PaY

- Zelle

Recommend to Read: Incredible Opportunities Of Integrating Apple Pay In iOS Mobile Apps

With the emergence of Blockchain technology in the FinTech industry, digital payment apps are becoming more secure and also offering cryptocurrency transactions. If you would like to develop a digital payment app for Android or iOS, add spice to it by using Blockchain technology and create a unique application to offer something new to your audience.

Get an answer for how to create a FinTech App or Digital Payment App Using Blockchain?

-

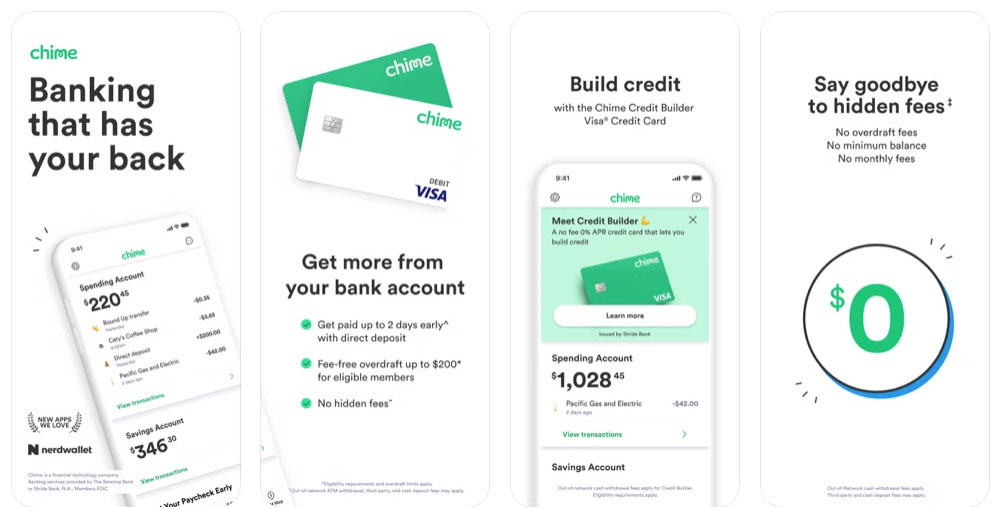

Mobile Banking Apps

The work is old, but it is a buzz in the industry in this COVID pandemic. Mobile banking applications are trending in the market. Every smartphone user with a bank account is installing mobile banking apps and accessing their accounts 24*7. Many of the banks are offering digital services to their customers.

Banking apps facilitate customers to view balances, check transactions, apply for loans, or request other credit or debit card-related services all online. Further, ATM locator and QR scanning facility for online payments are other significant benefits of the advanced mobile banking apps. Moreover, mobile banking applications often allow users to book online tickets, pay credit bills or mortgages, and exclusive cashback offers on online payments or purchases are a few best things about mobile banks.

-

Digital Money Lending Apps

Loan disbursal is a challenging task for banks. They need to verify the customer bank statements and other financial documents and check for their eligibility to ensure smooth loan repayment. But, with the emergence of Artificial Intelligence (AI)-powered money lending apps, the virtual agents will verify the records and check the customer’s eligibility in minutes.

AI-powered native mobile banking app for Android or iOS can efficiently handle the loan lending process digitally. PaySense, OppLoans, Biz2Credit, and MoneyTap are a few of the top FinTech companies that lend money to users by checking their civil scores.

These type of Fintech applications also sends payment reminders and missed payment notifications to the users for ensuring smooth transactions.

-

Investment and Trading Apps

Investment apps are a key category of Fintech applications that are in demand in the industry. These popular Fintech apps are financial advisors and provide the best investing experience for professionals or beginners.

Upon registration into the apps, these trending FinTech mobile applications allow users to sell or buy stocks, ETS, options, or cryptocurrency with zero commissions. The applications also give the users tips for managing their investments to get rapid returns.

Would you like to know the Development Cost of Investment Apps for Android/iOS?

Here is the list of major challenges that a Fintech company that decides to go digital might face.

6 Key Challenges Faced By FinTech Companies

#1. Security and Privacy

Security remains the biggest challenge for Fintech companies. Security and privacy of users’ confidential financial data is the first most important thing that a Fintech app company to provide to its customers. Enabling functionalities like FaceID, Fingerprint authentication process, transaction alerts in real-time will improve security level and prevent illegal activities on accounts.

#2. Integration of Blockchain

Though Blockchain technology is still in evolving phase, 80% of FinTech companies have adopting adopted it for providing end-to-end security across the network. Since the focus of FinTech companies is on ensuring security, integration of Blockchain technology in apps will help in tracking transactions and maintaining a clean financial ledger.

Talk to our experts & get the cost of Blockchain app development.

#3. Changing Regulations

Yes. Frequently changing government regulations are the biggest threats to the FinTech industry. With a focus on preventing frauds, digital Fintech solutions or apps help banks to monitor every transaction seven days a week.

Hence, machine learning, deep learning, and artificial intelligence-powered auto-analysis assist banks and FinTech companies in detecting frauds, creating reports without violating laws.

#4. Big data and AI integration

Approximately 75% of bankers believe that Artificial Intelligence (AI) technology will completely erase time-consuming manual processes and ensure automated processes across the chain. Integration of Big data and AI technologies will make Fintech apps more efficient and help financial companies collect and organize information securely.

These types of FinTech apps also help companies in tracking user behavior and improve app personalization. The development of AI and Big data-enabled Fintech apps is challenging, but if you hire one of the top AI app development companies in the USA, you can launch your AI Fintech app quickly and grab the market opportunities.

#5. Less Tech Experience

Fintech services provide the most convenient experiences to users. But, the development of top-notch FinTech applications will only be possible with immense experience in the mobile apps development field.

USM has over two decades of experience in the app development industry. Being the best banking and finance mobile app development company USM’s Fintech app developers integrate the most advanced and intelligent features, such as QR code payments, NFC chip, two-factor authentication, and many more, and develops powerful digital apps for finance companies.

#6. User Retention & User Experiences

Since the completion across the FinTech app development industry is crossing the sky limit, as a Fintech startup you must come up with the most advanced FinTech solution to stand in the frontline. User retention and user experiences are the two most significant factors that must remember during Fintech app development. Simply, your Fintech application must balance the user experience and performance.

So, create an eye-catching and easy-to-understand User Interface (UI) for your application and enhance the app experiences. USM Business Systems– one of the top native AI mobile app developers in the USA, build creative UI/UX designs for android and iOS mobile apps. Our team of graphic designers creates the most interactive UI that talks to your customers and improves app experiences.

Conclusion

If you’re thinking of Fintech app development, contact USM. We offer the best mobile app development and consultancy services to clients across the USA, India, UAE, Middle East, and many other countries. Our professional mobile app development team creates features-rich android and iOS apps for banking and financial companies. Let us know your app requirements, and we will develop a bugs-free Fintech application for your business.