10 Top FinTech Mobile Apps In The Middle East

10 Top FinTech Mobile Apps In The Middle East

The adoption of smartphones and technology applications in the Middle East countries like UAE, Saudi Arabia, Egypt, and Kuwait is growing rapidly. This trend is exploring massive growth opportunities for the mobile app development industry in the Middle East.

On the other hand, according to Statista, the number of mobile users in the Middle East is also doubled from 2014 to 2019. Moreover, the penetration rate of smartphones in the UAE and Saudi Arabia markets is reaching over 90% during 2020. Overall, with high-speed internet availability, access, and increasing smartphones and mobile app usage, the app development industry making its progress to become the leader on the global front.

We compiled a list of the best FinTech apps in the Middle East that are generating incredible profits in the banking and finance sector. These mobile banking applications facilitating the users in online bill payments, monitoring their credit or withdrawals, get instant personal loans, online investments, and many other digital banking services.

If you are into the Banking and Financial services industry, offering alternatives to such leading FinTech apps will ensure a bright scope and keeps your forefront of the digital competition in the region.

Let’s Start!

- myFawry

- Al Ansari Exchange

- AI Mulla Exchange

- MyFatoorah

- valU

- MoneyFellows

- eFAWATEERcom

- Tabby

- AMAN

- LuLu Money

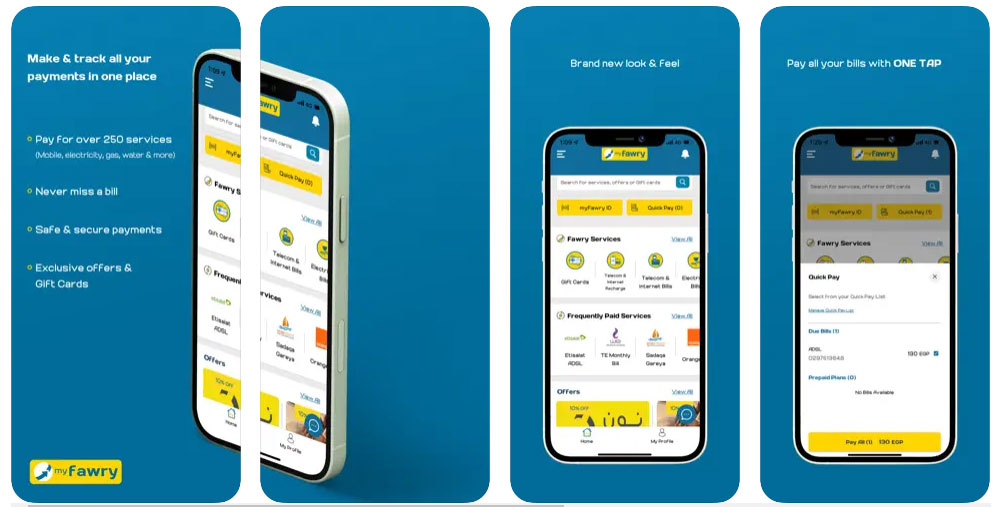

#1. myFawry – Leading e-payment platform in the Middle East

The myFawry app is the Number #1 FinTech app or digital mobile payment solution in the Middle East.

According to Fawry- a banking and payment technology Services Company in Egypt, their proprietary myfawry app has nearly 3.5 million downloads and generated $105 million annual revenues to the company as of July 2021.

It is top-rated as the best mobile payment platform that helps users to make all payments and transfers through a single podium. It allows users to pay utility bills, credit bills, bus ticket booking and also helps in tracking spending.

Features Of myFawry-like Top FinTech mobile App in the Middle East

- Highly secured login systems via fingerprint or face recognition

- Prepaid or post pad mobile recharge facility

- Users can pay gas, water, and electricity payments with a single click

- Instant bus ticket booking facility

- Users can schedule payment dates

- myFawry sends reminders and notifications of due bills

- Accepts payments through visa or master cards

- The app is used as a spending tracker

The free version of the app is available on Google Play and Apple App Store for Android and iOS users to download and grab the benefits of popular #e-payment apps like myFawry.

Would you like to develop a clone of myFawry? Get in Touch!

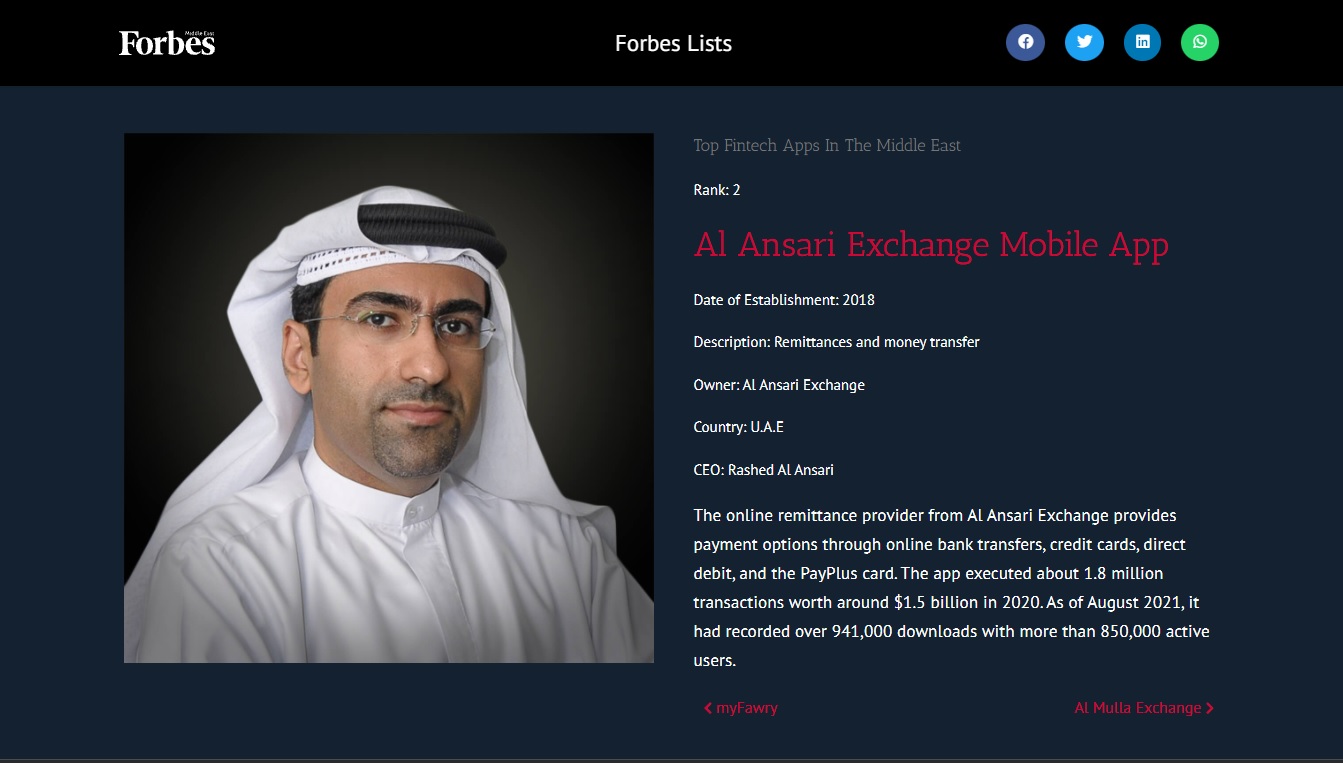

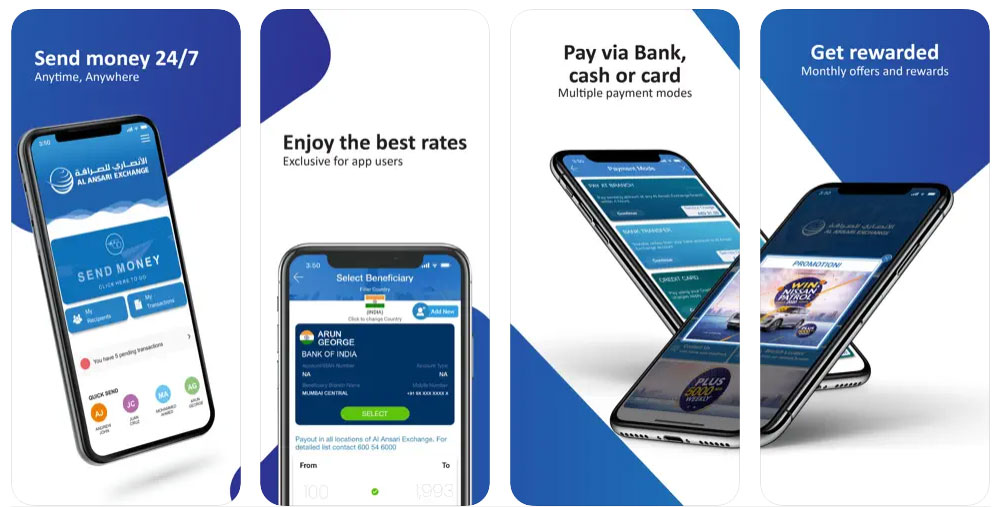

#2. Al Ansari Exchange Mobile App- Most-downloaded Banking app in the Middle East

Al Ansari Exchange Mobile app based on downloads and revenues is ranked as the second-largest FinTech app in the Middle East. As of August 2021, the app has 941,000 downloads and 850,000 active users.

This application offers simple and hassle-free payments, quick online money transfer services to the users. Using debit cards, credit cards, and the PayPlus card, users can pay their bills.

Its currency calculator, navigation, and real-time maps for locating banks are a few of the advanced features that are making this mobile payment application unique over others in the country.

Features of the most-used mobile payment app like AI Ansari Exchange App

- Easy-to-use user interface

- Easy to check transactions and beneficiaries

- The encrypted fingerprint authentication process

- Instant money sending services

- Multiple Currency Support

- Add beneficiaries and QuickSend features to transfer money in seconds

- Users can pay credit dues

- Multiple payment options

- Offers the best exchange rates on each transaction

- Get rewards

- Set reminders on bill payments

- Push notification on money transfers and payments

- Real-time exchange rates display

- Rate alerts- Sends alerts on the best change rates

Are you looking to develop an exact clone of this trending e-payment application?

USM Business Systems has a proven track record of FinTech app development. We have successfully developed and delivered top-not digital banking solutions for financial and banking service companies worldwide.

Our group of e-banking app developers located across the UAE, USA, India, Kuwait, and many other countries, capable to create results-driven customer-centric digital mobile banking apps.

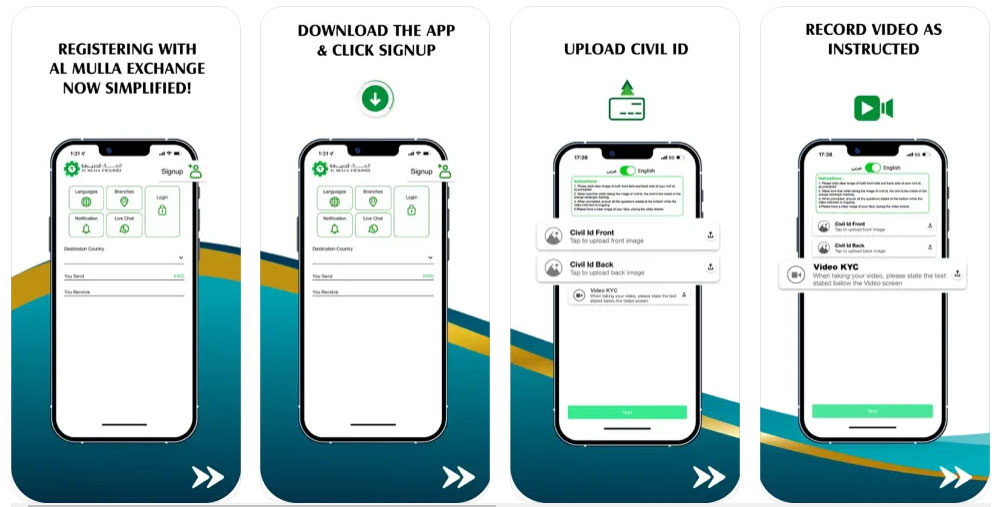

#3. Al Mulla Exchange App- The Best Remittance & Money Exchange App For Android & iOS

AI Mulla Exchange App is the top money sending app in Kuwait. Currently, the app has recorded 337,000 downloads through Google Play, Huawei App Gallery, and App Store.

According to the reports, over $1 billion transactions were securely done through AI Mulla Exchange App.

Features of Kuwait-based popular remittance app:

- Crystal clear dashboard with Service offerings

- Beneficiary listing to add contacts for a quick transaction

- Remit through selecting beneficiary from the list and by entering remittance details

- View or download transaction details

- My Transaction feature to view transaction history

- Explore currency exchange rates, pick the best rate and send through the same.

- Multilingual support- The app is available in seven languages

#4. MyFatoorah- One-stop revolutionary business payment App in the Middle East

MyFatoorah with a 4.3+ rating, 160,000 downloads, and 40,000 active FinTech app users ranked as the fourth largest digital payment application in the Middle East. It is a business

The app is developed by a leading Kuwait-based digital payment solutions provider, MYFATOORAH. It is primarily developed for businesses to make digital or paper-free invoices, Point-Of-Sale, and to share payment links through SMS and WhatsApp, etc.

As of July 2021, the app processed over $1.7 billion online transactions successfully.

Why is MyFatoorah FinTech App so Popular in the Middle East?

- It help businesses create invoices

- Dashboard view of recent invoices

- Create a digital invoice and send invoice details to link to customers through SMS or WhatsApp

- Track Invoice Status- Assist businesses in tracking paid and unpaid invoices list

- SMS notifications for quick payments

- The best platform to sell products

#5. valU- The Best Buy-Now-Pay-Later FinTech App in the Middle East

It is one of the pioneer FinTech app industries with the buy-now-pay-later concept in Egypt.

Users can shop for mobiles, fashion, furniture, and many more products across thousands of online stores located in Cairo, Alexandria, Giza, Hurghada, and other central areas of Egypt.

If you install this smart application, it lets you shop across 3,500 online stores, including Souq, IKEA, Azadea, and MAF, and pay for their products that you purchased in between six to 60 months. This amazing concept made this payment solution more popular in Egypt and other Middle Eastern countries.

As of August 2021, the downloads of valU from the Google Play Store and Apple App Store are 655,000.

Features of top FinTech Apps in Egypt like valU

- Shop online for products and make payment plans between 6-60 months.

- Search feature for exploring stores

- Push notifications

- Exclusive offers on selected products

- Invite friends

- Explore purchase history

- Set Repayment Plan, etc.

Talk to our expert mobile app developers about the estimated cost of e-Payment apps like valU.

#6. MoneyFellows- A Top Banking App In The Middle East

MoneyFellows is a FinTech app available to download on Google Play and Apple App Store for free. MoneyFellows provides credit offers and flexible payment options for users to pay in ROSCA (Rotating Credit and Savings Association) model. It reduces the burden on users to pay their borrowed money and pay inconvenient payment methods.

As of August 2021, the app has 173,000 active users and is downloaded over 1.6 million times during the year.

Benefits of group lending and savings platforms like MoneyFellows

- Trusted and convenient money circles

- Money loans to the money circles (a group of users)

- Zero% service fees

- Auto Debit or card payments on the scheduled due date

- Fixed payout date for all users

- Search feature to find suitable money circle and join

- Smart scoring and users can build a credit ladder

#7. eFAWATEERcom – Best platform for electronic payments

eFAWATEERcom is a famous bill payment app that is trusted by over 90% of the banking and financial service providers located across Jordan. Users of the eFAWATEERcom app can pay for nearly 250 types of bills in seconds through the app in an encrypted way.

As of 2020, the app has 500,000+ downloads and 381,000 active app users.

Functionalities of trending digital payment app

- Pay and manage bills, including utilities, mobile recharges, education, and many other purposes.

- Quick registration and access

- The advance payments feature let users pay bills before due dates

- Save and share bills

- Multi-payment modes

- View payment history

#8. Tabby- One of the biggest mobile payment solutions in the Middle East

Tabby is another popular FinTech app developed the same concept used by trending Egyptian mobile payment app like “valU”.

Over 90% of the online brands and businesses in the UAE are were already integrated and supporting Tabby payments at checkout. Tabby allows users to shop across brands and pay for their purchases later at zero interest rates.

Users can pay the full principle amount in four interest-free payments. The app also offers rewards to the users on every purchase. Moreover, with the launch of tabby Cashback in April 2021, the app also offers to attract discounts of nearly 20% on cashback on their purchases. This will further strengthen the app’s popularity in the country.

Features of Tabby FinTech App

- The search option to discover brands like AliExpress, Shein, IKEA, Max, and many more on the Tobby app.

- Buy now and pay later in four interest-free installments

- Deals and discounts offered by listed brands save big money

- Track and get alerts on due bills

- Flexible payment methods

- Push notifications on special shopping deals

How much does it cost to develop the most-used FinTech App in the Middle East like tabby? Let’s Talk.

#9. AMAN-The Best Finance Application to Egyptian Businesses

AMAN is offered by Raya Holding for Financial Investments Company that strives to accelerate cashless payment services in Egypt. The app is the best e-payment solution for various mobile bill payments, utility bill payments, and digital wallet recharges, and many more.

#10. LuLu Money- Quick money transfer app in UAE

LuLu Money is the UAE-based largest money remittance app. It is a one-stop digital payment solution for all types of payments and money remittances. It allows users to instantly send money to directly bank accounts in over 100 countries.

The LuLu Money app recorded 890,000 downloads and processed money transfers and payments of around 825,000 transactions during 2020.

The app’s flourishing features are giving intensified competition to other apps that are in the same category. Here are the significant features of LuLu Money-like tending FinTech apps.

Features and functionalities of instant money transfer and payment service app li LuLu Money

- Transfer money to 100+ bank accounts

- Track transactions status in real-time

- e-wallet feature for Expatriate

- Currency exchange rates calculator

- AI virtual Bot feature to stay tuned with app users 24/7

- Supports multi-payment systems, including payroll management cards, WPS salary cards, credit/debit cards, and many more

The Future Of Mobile Application Development In The Middle East

Besides oil & gas reservoirs and geopolitical topics, the Middle-East region is becoming a center for mobile apps innovations.

Yes. Mobile application development is a hot topic across UAE, Saudi Arabia, Kuwait, Egypt, Jordan, and many other countries.

With the increasing adoption of cutting-edge technologies in the Arab countries, like Dubai and Saudi, the region is becoming a powerful hub for tech-driven intelligent mobile apps.

Despite a tough economic situation in the region, Middle-Eastern companies are rushing forward towards mobile app development and raising funds since the outbreak of Covid-19.

This trend is driving the emergence of hundreds of mobile app development startups in the region. Not only for the app developers, the business across various industry verticals, including retail, banking, finance, healthcare, manufacturing, and the education sector, are all planning to invest in mobile apps to deliver more personalized services to their audience.

So, the growth of the mobile app development sector in the Middle East will flourish in the years ahead.

Conclusion

The United Arab Emirates, Kuwait, Saudi Arabia markets have become the center of the Middle East’s mobile app development sector growth. These markets are ensuring exceptional mobile app development opportunities for brands.

In particular, due to the COVID-19 pandemic, individuals are more focused on downloading instance service delivery apps, including banking and finance apps.

The FinTech apps that are listed above will encourage zero-contact payments and also reduces COVID spread. They let the users get banking and finance services online at the convenience of home.

Hence, this is the right time for banking and financial service providers to launch e-wallet apps/e-payment apps, or finance apps and generate millions of business.

Moreover, you cannot reach a 100% targeted audience through offline business. So, being the best mobile app development services provider and consultant, we suggest finance companies invest in banking apps development and deliver reliable and instant services to the targeted audience.

USM Business Systems, the best Finance Mobile Apps Development Company in the Middle East, let your app come live with a bunch of unique and customer-focused features and functionalities.