Tips to Banks for Optimizing Security Level in their Mobile Banking Apps

Tips to Banks for Optimizing Security Level in their Mobile Banking Apps

The popularity of mobile banking services is on top of in-branch banking systems. Nearly 75% of bank account holders are installing banking apps for instant money transfers, checking balance and loans dues, or requesting banking services online. Thus, mobile banking apps are facilitating a convenient and comfortable experience for the users.

But, the cyber intruders on the other side are very eager to create opportunities from online banking services. Mobile banking applications are the best platform for intruders to hack bank accounts or theft sensitive banking information of the users.

To overcome these challenges or put an end to the legal activities of cybercriminals, banking apps for android or iOS need to be developed with the few security standards for making digital banking services safe and secure and assist banks in protecting their customers’ confidential data.

Here are the five significant things that mobile apps developers and banks should remember while mobile banking and finance apps development.

-

Induce Fingerprint Authentication

Fingerprint authentication is the most encrypted way to identify the user’s credentials and prevent illegal access to the app. By recording the unique set of signals (like device IP, location details, time and day of app access, and many more) banking apps with fingerprint verification feature confirms the user’s identity and ensures high-level protection.

- Alerts & E-mail Notifications In Real-time

Integrate your mobile banking application with security alerts on every transaction done by the users. This functionality help users to know what is happening to their accounts. Besides, sending email notifications in real-time will also further help users to identify fraud transactions if any.

This feature allows banks to notify their customers about money transfers, withdrawals, online payments, purchases, profile edits, and many more for enhanced security levels.

- Multi-factor Authentication Functionality

Since mobile banking apps are highly disposed to frauds, enabling in-app multi-factor authentication functionality is the best to prevent fake transactions or any other illegal banking activities. So, you’re banking apps needs to be integrated with many folds of security layers such as One-Time-Passwords or fingerprints, iris verification, etc., while customers transact money or downloading statements.

Hence implementation of multi-factor authentication functionality prevents fraud and offers users the most unique ways of interacting with their accounts safely all the time.

- Integration of SIEM Tools

Integration of Security Information and Event Management (SIEM) tools in apps help banks to monitor threats and trigger fraudulent acts across the network. These tools are efficient in analyzing data records in real-time and preventing unauthorized access to the account.

- Educate or Inform Customers About Frauds

It is one of the most important factors among all others. Going digital in the sense of giving opportunities for cyber-attacks. One must be careful while using online banking services, otherwise your money will be drained out without your interference.

Banks should educate their customers regarding the scope of illegal acts of attackers. If your bank is offering services through mobile banking applications, you should support customers in usage and how to prevent illegal transactions intelligently. You can even send security alert messages or calls to customers from apps.

USM Business Systems is one of the best mobile apps development companies engaged in the development of native android and iPhone/iOS apps. We are also ranked as the best web apps development services provider driven by our unique set of successfully delivered web applications.

Does Integration Of Artificial Intelligence Technology In Banking Apps Provide High Security?

100% yes. Artificial Intelligence (AI) algorithms help banks improve fraud detection and prevention functionalities. Integration of AI in mobile banking ensures provides secure and instant transactions by preventing unauthorized access to the user’s accounts.

Moreover, AI-based mobile applications, based on the behavior analysis of the user’s previous transactions can identify suspicious activities instantly and alert the users.

Further, Artificial Intelligence also has an incredible scope in the domain of cybersecurity. So, the implementation of AI-based fraud detection functionalities in mobile apps will also play a significant role in protecting data from cyber-attacks.

USM, one of the top mobile apps development services providers, with a group of AI development experts can create futuristic AI-powered mobile banking apps for the banking and financial sector to address the issue of fraud and data breaches with ease.

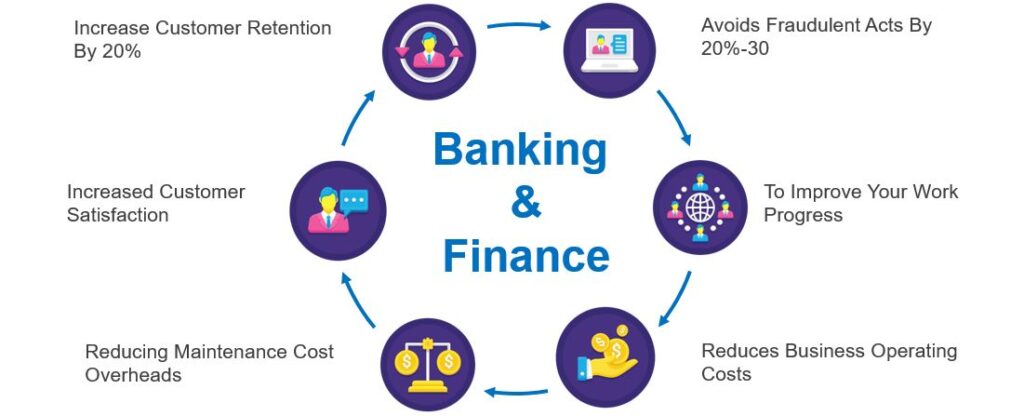

How do USM’s banking and financial mobile apps help banks other than detecting and preventing frauds?

These are just a few benefits, banks can benefit from brand awareness, informed decision making while disbursing loans, audit and record transaction data to be compliant with regulatory systems, and stay in touch with their customer through virtual customer support services.

If you planning for an insurance app, investment app, and e-wallet or digital payment application, let’s talk and create truly unique AI-driven mobile banking apps.

A guide for banks for estimating the banking app development cost

While developing a banking application for android or iOS, one must consider the factors below to draw an approximate budget for app development.

-

UX or UI Design

The design of the mobile banking application or UI should be eye-catchy. It should be easy for users to navigate through inner pages and access the features with simple clicks. One must also remember that add attractive icons and graphic images to enhance the look of your banking app.

So, mobile apps with attractive UI might increase the estimated development cost, but at the same time, app appearance and user experience are also be improved.

-

Features and functionalities

Users will install banking apps for multiple purposes, such as online transfers, balance checks, bank statement requests, checkbooks requests, and many other services. So, if you wish to develop a banking application, you must look over what your target audience will expect from your app.

Generally, a banking app with basic features, such as profile creation and management, balance visibility, processing instant money transfer, will cost around $25000-$35000. If you want to add more advanced features like tracking credit score in real-time, an EMI calculator, data analytics, QR scanner for payments will go beyond $50,000.

-

Android or iOS

The app platform that you selected for developing an app will change the overall estimated development cost of the mobile app. For instance, due to higher device compatibility, the banking or finance mobile apps development on Android is a little bit expensive than iOS app development.

We, being the trusted app developer, suggest banks decide the app’s platform based on the platform share of the target audience. It means that if you have a maximum share of your targeted audience across the android platform, then invest in android banking apps development or select either platform for giving a big hit across app stores.

-

Team Size

The mobile banking app development also depends on the team size of the app developer. If the mobile app development company you choose has no required resources, they need to hire and fill the skill gap in the team. It will add an extra budget to the overall estimated app development price.

USM is a popular mobile applications development company in the USA, India, UAE< and other markets. We have a super talented app development team, including Project managers, UX/UI designers, Android and iOS developers, Backend developers, Testing team, and Quality Assurance (QA) engineers.

With having all reburied app development resources, USM can build your app within your budget. Let’s talk!

-

Developers Location

The location of the mobile app developers will decide the mobile app development cost. For instance, the hourly rate of the mobile app developers in the USA might vary from mobile app development companies located in European or Asian markets.

Contact us to know the mobile #apps development cost in the United States or India.

How Much Does It Cost To Develop A Banking App For Android, iOS?

The banking app development cost using AI technologies will be around $35,000 to $130,000. Being the best mobile app development agency, our AI app development consultants estimated that:

- The banking app development cost with basic features and simple UI on either android or iOS platform will be around $20,000-$35,000.

- The estimated cost of developing a user-friendly mobile banking app with advanced features like sending fraud alerts, enabling QR code payments, AI chatbot assistance, cheque deposits, will be around $50,000-$80,000.

- The #mobile banking apps development cost with complex UI for Android and iOS will be around $70,000-$130,000.

However, as we discussed in the above section, this estimated cost will be varied depending on banking application features, platform (android/iPhone/iOS), type (hybrid/native/cross-platform), and the complexity level of the app’s User Experience (UX)/ User Interface (UI).

Besides, the price of mobile apps for banks will also be contingent on the location of the mobile app developers, mobile apps development team size, and working hours they took for each module development.

Conclusion

Mobile banking or e-banking apps development іs simple and worth in this rapidly evolving world of technology. So, digitize your banking operations and provide highly safe, secure, and hassle-free online banking services to your customers.

Let’s discuss and build a best-in-class mobile banking application.